Welcome!

To the latest Hino Express Newsletter

We’ve been hard at work to bring you a newsletter that is designed to both look great and function well right in your web browser. We trust you will find the content informative and helpful. Feel free to click to each page using the navigation, or simply scroll down. On the last page you will find a form requesting your feedback; please let us know how we’re doing!

Letter from the COO

As we enter a new calendar year, we greet it with a sense of hope and optimism: hope that the effects of COVID-19 will recede this year, and optimism that we can soon return to normalcy – or at least what we may soon call “the new normal” – along with the full resumption of Hino production. It has been some time since we could provide our exceptional Hino product to our most valued customers, and we look forward to that prospect.

Despite the challenges we – and the world – faced, I am delighted to report that TICF has had a banner year so far. As most of you are aware, TICF reports on a fiscal basis, with March 31st as our annual ending date. In my note to you last April, I shared our aspirational goal of attaining 40% retail market share, a performance never realized by TICF. I’m proud to report that through December, TICF has beat that goal, accomplishing 43% market share, even in the face of limited new Hino volume due to production disruptions.

While the volume is impressive, I find it even more significant how we pivoted in supporting our Hino dealer network in respect to their sales of non-Hino and used vehicles. Again, through December, we have acquired over $302 million in this segment, surpassing our annual goal of $189 million. Overall, we have acquired over $426 million from our Hino network. A final quantitative accomplishment resides in our credit department where we approved just over 80% of all submitted Hino credit applications.

Based on these noteworthy achievements, it’s clear we have substantial momentum heading into 2022. We remain committed to providing best-in-class dealer and customer service, innovative financial solutions, and continued integration with HMS, our valued manufacturing partner.

And we know that we couldn’t have done it without the strong support we have received from each one of you as we all forged our way in these untenable times.

We also have several exciting initiatives in store as we expand our sales team to support you, improve TC3 to make doing business even easier, and further enhance our Hino customer portal in support of features your customers need.

As we reflect on these auspicious accomplishments, I wish to thank each and every TICF associate for their role in helping us excel and continuing our quest to be the financial services partner of choice for you, our valued dealer.

Ron Storz

Chief Operating Officer

On the precipice of our fourth annual dealer survey, TICF looks forward to new insights

The fourth annual Dealer Satisfaction Survey will begin fielding at the end of February, and TICF couldn’t be more excited to see dealers’ perspectives on how service has held up while the pandemic has dragged on.

It is clear that the COVID-19 pandemic is still affecting business, and we empathize with the challenges you continue to face. Last year, we learned that 75% of respondents felt supported with our response to the pandemic.

These results also mean that 25% of dealers felt we could have done better, and that is where our focus has been the past year. With feedback on COVID-19 and every aspect of our service, we continue to make a genuine effort to provide even more meaningful support to you and our mutual customers.

While there are areas of opportunity all along the dealer experience, our action focused on:

- Improving speed and responsiveness to inquiries.

- Admittedly volume has been high, and we’ve had staffing challenges due to COVID; however, later this quarter we are launching new reporting to provide greater transparency every month in this regard.

- Developing an effective, efficient, and dealer-centric process for expediting solutions to funding issues.

- A new funding checklist and DocuSign documents are available to head off funding issues.

- Continuing to improve TC3 functionality, the user experience, and user support.

- Tools and training have helped us achieve TC3 utilization of 44%, and a new TC3 quick app interface is being developed for launch later this calendar year.

Last year we further invested in the Hino business and added a Customer Satisfaction Survey. There, too, we were delighted to learn and share that more than 60% of respondents said they were likely to recommend us. These are customers who will return to you and bring other customers with them.

Key takeaways from the customer survey were that we must add a customer portal, improve the payoff process, and become more effective in solving customer questions and problems.

We are pleased to report that we launched a customer payment portal in August of 2021, and nearly 50% of customers are signed up to utilize the system.

In the Toyota spirit of Kaizen, there is always room for improvement, and we look forward to this year’s dealer and customer feedback to help us focus on the areas of our business that matter most to you.

Dealer Satisfaction & Customer Satisfaction Surveys

On the precipice of our fourth annual dealer survey, TICF looks forward to new insights

The fourth annual Dealer Satisfaction Survey will begin fielding at the end of February, and TICF couldn’t be more excited to see dealers’ perspectives on how service has held up while the pandemic has dragged on.

It is clear that the COVID-19 pandemic is still affecting business, and we empathize with the challenges you continue to face. Last year, we learned that 75% of respondents felt supported with our response to the pandemic.

These results also mean that 25% of dealers felt we could have done better, and that is where our focus has been the past year. With feedback on COVID-19 and every aspect of our service, we continue to make a genuine effort to provide even more meaningful support to you and our mutual customers.

While there are areas of opportunity all along the dealer experience, our action focused on:

- Improving speed and responsiveness to inquiries.

- Admittedly volume has been high, and we’ve had staffing challenges due to COVID, however, we are launching new reporting to provide greater transparency every month in this regard.

- Developing an effective, efficient, and dealer-centric process for expediting solutions to funding issues.

- A new funding checklist and DocuSign documents are available to head off funding issues.

- Continuing to improve TC3 functionality, the user experience, and user support.

- Tools and training have helped us achieve TC3 utilization of 44%, and a new TC3 quick app interface is being developed for launch later this calendar year.

Last year we further invested in the Hino business and added a Customer Satisfaction Survey. There, too, we were delighted to learn and share that more than 60% of respondents said they were likely to recommend us. These are customers who will return to you and bring other customers with them.

Key takeaways from the customer survey were that we must:

- Add a customer portal

- Improve the payoff process

- Become more effective in solving customer questions and problems.

We are pleased to report that we launched a customer payment portal in August of 2021, and nearly 50% of customers are signed up to utilize the system.

In the Toyota spirit of Kaizen, there is always room for improvement; however, we look forward to this year’s dealer and customer feedback to help us focus on the areas of our business that matter most to you.

“A FIVE-STAR EXPERIENCE”

In the face of the continuing pandemic, TICF helps dealers and customers weather the storm

It is no secret that the COVID-19 pandemic continues to impact businesses around the world. In the face of economic hardship and supply chain issues, many companies have been forced to close their doors. However, two years later, Toyota Industries Commercial Finance (TICF) continues to stand strong alongside its dealer partners, ensuring commercial customers secure the vehicle financing support they need to weather the storm.

Brian O’Neil, Vice President and Co-Owner of Industrial Power, has seen TICF’s customer focus first-hand.

“When COVID first hit, we had a customer who was struggling,” he explained. “The pandemic immediately stopped [our customer’s] business.”

O’Neil, who co-owns Industrial Power with his father, has been doing business with TICF for more than a decade. “We work with TICF on floor planning all of our Hino trucks. They also finance our lease and rental trucks, and we would consider using them for our real estate financing as well,” he shared. “We consider them a one-stop shop and a significant part of our business.”

When the pandemic hit in 2020 and his customer needed accommodations, TICF worked closely with Industrial Power to come up with a solution that benefitted both the dealer and the customer. “It was a complicated situation that most finance companies wouldn’t have been able to make happen,” said O’Neil. “It took a lot of work, but TICF stepped up and got it done.”

TICF’s commitment to quality and customer service is what allowed the team to provide such impactful assistance. O’Neil and his dealership believe that this commitment is what sets TICF apart from other lending organizations. On the dealer financing side of the business, O’Neil attests that TICF is a true partner, working to reduce both cost and stress by providing a seamless experience. With its easy-to-use systems and exceptional rates and service, TICF helps O’Neil and his dealership save time and money, which makes for a more efficient business and greater profit.

But it is the personal touch that makes TICF stand out from other lenders. “They are a smaller organization, so we have close relationships—from the top down,” O’Neil said. The team at Industrial Power has forged strong bonds with the TICF associates servicing their account, and they also have fostered crucial partnerships with key decision makers within the lending organization. “That is very unique when working with a financial institution,” O’Neil explained. “They will work closely with us to actually close deals. It’s a game changer.”

“They will work closely with us to actually close deals. It’s a game changer.”

TICF’s ambitious approach to dealer and retail financing is a “win-win-win-win-win” for TICF, Hino, the dealer, the truck owner, and team members at every organization. O’Neil shared that on the dealer side of things, TICF provides favorable terms without requiring a personal guarantee. He also shared that many of Industrial Power’s large fleet deals were made possible by TICF’s ability to provide comprehensive retail financing and lines of credit for customers. Ultimately, TICF’s willingness to go above and beyond by joining sales calls and working through complex financing situations outshines the efforts of the competition. “Everyone at TICF has your best interest at heart,” O’Neil expressed. “It is a five-star experience.”

“A FIVE-STAR EXPERIENCE”

In the face of the continuing pandemic, TICF helps dealers and customers weather the storm

It is no secret that the COVID-19 pandemic continues to impact businesses around the world. In the face of economic hardship and supply chain issues, many companies have been forced to close their doors. However, two years later, Toyota Industries Commercial Finance (TICF) continues to stand strong alongside its dealer partners, ensuring commercial customers secure the vehicle financing support they need to weather the storm.

Brian O’Neil, Vice President and Co-Owner of Industrial Power, has seen TICF’s customer focus first-hand.

“When COVID first hit, we had a customer who was struggling,” he explained. “The pandemic immediately stopped [our customer’s] business.”

O’Neil, who co-owns Industrial Power with his father, has been doing business with TICF for more than a decade. “We work with TICF on floor planning all of our Hino trucks. They also finance our lease and rental trucks, and we would consider using them for our real estate financing as well,” he shared. “We consider them a one-stop shop and a significant part of our business.”

When the pandemic hit in 2020 and his customer needed accommodations, TICF worked closely with Industrial Power to come up with a solution that benefitted both the dealer and the customer. “It was a complicated situation that most finance companies wouldn’t have been able to make happen,” said O’Neil. “It took a lot of work, but TICF stepped up and got it done.”

TICF’s commitment to quality and customer service is what allowed the team to provide such impactful assistance. O’Neil and his dealership believe that this commitment is what sets TICF apart from other lending organizations. On the dealer financing side of the business, O’Neil attests that TICF is a true partner, working to reduce both cost and stress by providing a seamless experience. With its easy-to-use systems and exceptional rates and service, TICF helps O’Neil and his dealership save time and money, which makes for a more efficient business and greater profit.

But it is the personal touch that makes TICF stand out from other lenders. “They are a smaller organization, so we have close relationships—from the top down,” O’Neil said. The team at Industrial Power has forged strong bonds with the TICF associates servicing their account, and they also have fostered crucial partnerships with key decision makers within the lending organization. “That is very unique when working with a financial institution,” O’Neil explained. “They will work closely with us to actually close deals. It’s a game changer.”

“They will work closely with us to actually close deals. It’s a game changer.”

TICF’s ambitious approach to dealer and retail financing is a “win-win-win-win” for TICF, Hino, the dealer, the truck owner, and team members at every organization. O’Neil shared that on the dealer side of things, TICF provides favorable terms without requiring a personal guarantee. He also shared that many of Industrial Power’s large fleet deals were made possible by TICF’s ability to provide comprehensive retail financing and lines of credit for customers. Ultimately, TICF’s willingness to go above and beyond by joining sales calls and working through complex financing situations outshines the efforts of the competition. “Everyone at TICF has your best interest at heart,” O’Neil expressed. “It is a five-star experience.”

Top Performing Dealers

In each issue of the Hino Express we announce the Top 10 Dealers by volume. To provide recognition to dealers of varying sizes, we’re listing our Top Performing Dealers segmented by size with a delineation at 25 units funded with TICF in the case of volume.

Every Hino Trucks dealership is valued by TICF, and we want to note our appreciation of all business. Ranking shown for business between 10.1.21 – 12.31.21.

25 OR MORE

| RUSH TRUCK CENTER |

| TRUCKMAX HINO OF MIAMI INC. |

| GABRIELLI |

| KRIETE GROUP |

| NUTMEG INTERNATIONAL TRUCKS, INC |

| TOM’S TRUCK CENTER |

| COLUMBUS TRUCK & EQUIPMENT |

| BENTLEY |

| RWC |

| JOHN LYNCH CHEVROLET-PONTIAC SALES INC. |

25 OR LESS

| MHC |

| M & K |

| MATHENY |

| TP INVESTMENT GROUP, LLC |

| WORLDWIDE |

| BRUCKNER TRUCK SALES, INC. |

| BERGEY’S |

| K. NEAL |

| RECHTIEN INTERNATIONAL TRUCKS, INC. |

| TEC EQUIPMENT |

Top Performing Dealers

In each issue of the Hino Express we announce the Top 10 Dealers by volume. To provide recognition to dealers of varying sizes, we’re listing our Top Performing Dealers segmented by size with a delineation at 25 units funded with TICF in the case of volume.

Every Hino Trucks dealership is valued by TICF, and we want to note our appreciation of all business. Ranking shown for business between 10.1.21 – 12.31.21.

25 OR MORE

| RUSH TRUCK CENTER |

| TRUCKMAX HINO OF MIAMI INC. |

| GABRIELLI |

| KRIETE GROUP |

| NUTMEG INTERNATIONAL TRUCKS, INC |

| TOM’S TRUCK CENTER |

| COLOMBUS TRUCK & EQUIPMENT |

| BENTLEY |

| RWC |

| JOHN LYNCH CHEVEROLET-PONTIAC SALES INC. |

25 OR LESS

| MHC |

| M & K |

| MATHENY |

| TP INVESTMENT GROUP, LLC |

| WORLDWIDE |

| BRUCKNER TRUCK SALES, INC. |

| BERGEY’S |

| K. NEAL |

| RECHTIEN INTERNATIONAL TRUCKS, INC. |

| TEC EQUIPMENT |

It’s Spring Break Planning Time!

Earn More Elite Dealer Rewards to Upgrade Yours

Are you enrolled for Elite Dealer Rewards? If not, you’ll want to sign up today for this exclusive rewards program presented by Toyota Industries Commercial Finance (TICF) for dealer personnel.

Financing your sales with TICF gives you the opportunity to earn a wide range of valuable prizes that include name-brand merchandise, event tickets, travel packages, and much more.

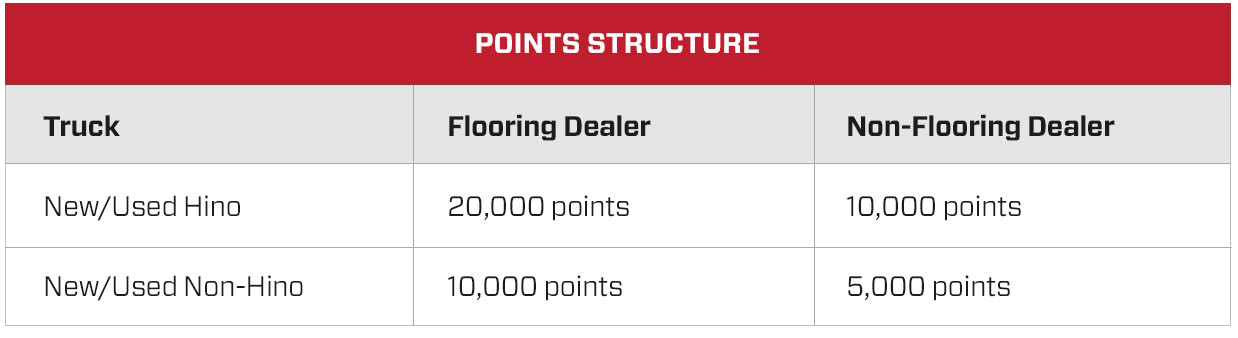

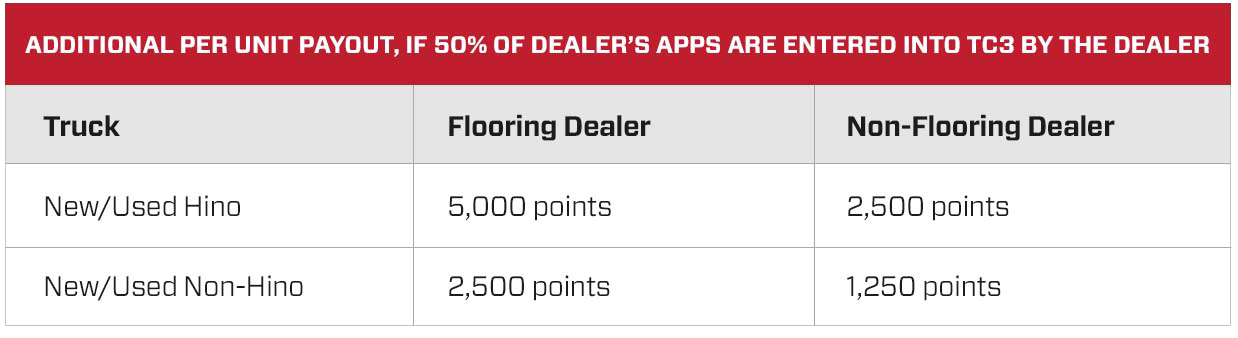

And for a limited time, the rewards are even more generous. Right now, every truck financed with TICF is eligible for points based on the following payouts:

Note that:

- Terms apply to qualifying business funded between January 1, 2022, and March 31, 2022.

- Points structure above awarded monthly between February 2022 and April 2022 based on the prior month’s qualifying deals and TC3 applications.

- Dealers must be opted into the Elite Dealer Rewards program to be eligible to earn points.

- All other program terms, conditions, and rules are applicable.

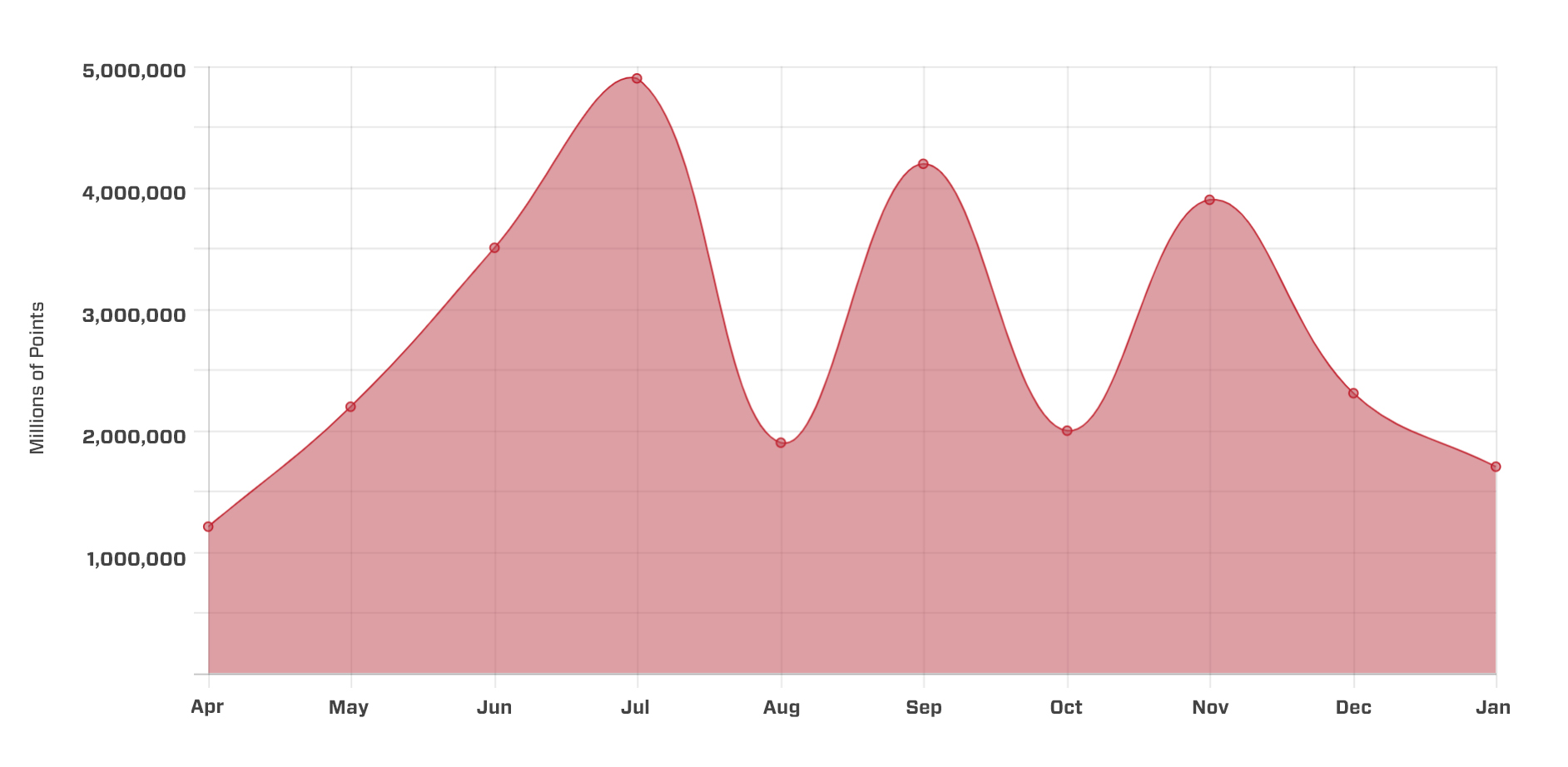

The third year of the program is the most awarding to date!

Already more than 28 million points have been awarded this fiscal year.

Wondering how others used their points last year?

Check out the charts by category below.

TOP 10 BY POINTS

Join the club and start accruing points today that you can redeem for your spring break vacation (or even hard-to-find car rentals on vacation) or use them to get more enjoyment out of your leisure time “staycation,” such as a patio firepit table and Sonos speaker or a host of smaller luxuries like deluxe cabernet glasses and backyard games.

Wondering how others used their points last year?

Check out the charts by category below.

TOP 10 BY POINTS

Join the club and start accruing points today that you can redeem for your spring break vacation (or even hard-to-find car rentals on vacation) or use them to get more enjoyment out of your leisure time “staycation,” such as a patio firepit table and Sonos speaker or a host of smaller luxuries like deluxe cabernet glasses and backyard games.

Get Up to Speed on TC3

TICF recently added new resources to help you better understand the seamless process of using TC3 to conveniently package the information needed to finance your commercial truck deals. Enjoy faster turnaround times, better visibility on deal status, and improved communication. (And get more Elite Dealer Rewards points to boot!)

Watch the videos and use these quick links to get started today.

Why TC3?

Entering a Credit App in TC3

Understanding the Credit Approval Process

Contract Set Up & Documentation

TC3 QUICK LINKS

Meet Your Regional Sales Manager

Mike Francani

When opportunity knocked, Mike Francani, TICF’s newest Regional Sales Manager, answered the door. Now, he’s bringing his 20+ years of experience in credit and sales to TICF where he will report to Senior Regional Sales Manager Keith Courtney.

Mike’s career in finance began shortly after college when he joined Chrysler Financial—at the time a Daimler company—where his first role was in 30-day collections; progressing to 90-day collections, skip tracer, and repossessions; bankruptcy and then credit. He spent seven years at Chrysler Financial before relocating to Texas in 2009, as a credit buyer for Mercedes-Benz Financial Services in the consumer market. In 2010 he changed roles to commercial credit analyst with Daimler Truck Financial, and in 2014, Mike returned to the Northeast as a commercial finance representative for Freightliner, Western Star, and FUSO trucks, as well as Thomas Built Buses.

It turned out to be a fascinating switch. “Car credit is essentially the same with each transaction, whereas the truck side offers more variety with the nuances of commercial vehicles, a variety of equipment, and different industries,” Mike says.

As a commercial credit analyst, he became a specialist in vocational credit. For nearly five years, he came to know the credit business inside and out, then pivoted to the field as a sales representative for Thomas Built Buses and FUSO, covering the same territory he currently has with TICF, from Pennsylvania to Maine. Most recently he was a District Finance Manager responsible for providing financing for Freightliner and Western Star trucks.

During his time working with FUSO trucks, Mike always regarded Hino as a solid company and worthy competitor. Having worked with Keith in the past, his interest was piqued when he came calling. “I wasn’t looking, but Keith found me at the right time. He taught me a lot out in the field and has always been supportive.”

“Forming relationships and bringing a dose of creativity is key because in the world of captives, you have to do more than just quote a rate. You also have to supply meaningful solutions,” he notes. “We know we’re not always the lowest rate, but we add value in lots of other ways that help our dealers and their customers be successful.”

Mike’s favorite aspect of the business is getting to know customers in the relatively small industry. “The people I’ve met and dealers I work with are the factors that make my career so fulfilling,” he says. “Seeing familiar faces at trade shows and industry events creates a tight-knit professional community of associates you trust.”

In addition, Mike appreciated the opportunity to stay with his existing territory, where half the dealers he’ll be visiting are within a 200-mile radius of his home. “I love the lifestyle of being a rep in the field and can’t wait to get back out there, meeting new people and helping Hino grow and gain more market share,” he says.

He believes that TICF offers a variety of competitive products which will support that aim. “I don’t view it as a sales job so much as one that combines account management, customer satisfaction, and customer management,” he says.

Over the years Mike has discovered the satisfaction of working with smaller customers where he has the opportunity to help grow their business. “As a financing partner you mean a lot to them, and as they expand, you can truly see the fruits of your labor and feel as though you played a role in their success.”

“As a financing partner you mean a lot to them, and as they expand, you can truly see the fruits of your labor and feel as though you played a role in their success.”

Building those relationships is core to Mike’s sales ethos. “I want my customers to know I am their advocate. I won’t win every deal on rates, but in my experience captive finance can offer a ton of flexibility and trade-offs. Big banks that aren’t associated with the product don’t have the same loyalty,” he says.

While sales is in his blood, his heart belongs to his family – his wife Katie, and his daughters, Nina and Alice, ages 8 and 9. He loves spending time with them “doing what they want to do,” he says, although he makes sure to find the chance to cheer on the local Philadelphia sports teams and read history when he can find a quiet moment.

Meet Your Regional Sales Manager

Mike Franciani

When opportunity knocked, Mike Francani, TICF’s newest Regional Sales Manager, answered the door. Now, he’s bringing his 20+ years of experience in credit and sales to TICF where he will report to Senior Regional Sales Manager Keith Courtney.

Mike’s career in finance began shortly after college when he joined Chrysler Financial—at the time a Daimler company—where his first role was in 30-day collections; progressing to 90-day collections, skip tracer and repossessions; bankruptcy and then credit. He spent seven years at Chrysler Financial before relocating to Texas in 2009, as a credit buyer for Mercedes-Benz Financial Services in the consumer market. In 2010 he changed roles to commercial credit analyst with Daimler Truck Financial, and in 2014, Mike returned to the Northeast as a commercial finance representative for Freightliner, Western Star, and FUSO trucks, as well as Thomas Built Buses.

It turned out to be a fascinating switch. “Car credit is essentially the same with each transaction, whereas the truck side offers more variety with the nuances of commercial vehicles, a variety of equipment, and different industries,” Mike says.

As a commercial credit analyst, he became a specialist in vocational credit. For nearly five years, he came to know the credit business inside and out, then pivoted to the field as a sales representative for Thomas Built Buses and FUSO, covering the same territory he currently has with TICF, from Pennsylvania to Maine. Most recently he was a District Finance Manager responsible for providing financing for Freightliner and Western Star trucks.

During his time working with FUSO trucks, Mike always regarded Hino as a solid company and worthy competitor. Having worked with Keith in the past, his interest was piqued when he came calling. “I wasn’t looking, but Keith found me at the right time. He taught me a lot out in the field and has always been supportive.”

“Forming relationships and bringing a dose of creativity is key because in the world of captives, you have to do more than just quote a rate. You also have to supply meaningful solutions,” he notes. “We know we’re not always the lowest rate, but we add value in lots of other ways that help our dealers and their customers be successful.”

Mike’s favorite aspect of the business is getting to know customers in the relatively small industry. “The people I’ve met and dealers I work with are the factors that make my career so fulfilling,” he says. “Seeing familiar faces at trade shows and industry events creates a tight-knit professional community of associates you trust.”

In addition, Mike appreciated the opportunity to stay with his existing territory, where half the dealers he’ll be visiting are within a 200-mile radius of his home. “I love the lifestyle of being a rep in the field and can’t wait to get back out there, meeting new people and helping Hino grow and gain more market share,” he says.

He believes that TICF offers a variety of competitive products which will support that aim. “I don’t view it as a sales job so much as one that combines account management, customer satisfaction, and customer management,” he says.

Over the years Mike has discovered the satisfaction of working with smaller customers where he has the opportunity to help grow their business. “As a financing partner you mean a lot to them, and as they expand, you can truly see the fruits of your labor and feel as though you played a role in their success.”

“As a financing partner you mean a lot to them, and as they expand, you can truly see the fruits of your labor and feel as though you played a role in their success.”

Building those relationships is core to Mike’s sales ethos. “I want my customers to know I am their advocate. I won’t win every deal on rates, but in my experience captive finance can offer a ton of flexibility and trade-offs. Big banks that aren’t associated with the product don’t have the same loyalty,” he says.

While sales is in his blood, his heart belongs to his family – his wife Katie, and his daughters, Nina and Alice, ages 8 and 9. He loves spending time with them “doing what they want to do,” he says, although he makes sure to find the chance to cheer on the local Philadelphia sports teams and read history when he can find a quiet moment.

Did you pay attention?

Take this one-question quiz for your chance to earn 1,000 Elite Dealer Reward points, if you are a participating dealer.

Did you pay attention?

Take this one-question quiz for your chance to earn 5,000 Elite Dealer Reward points, if you are a participating dealer.

Looking Ahead!

We are already planning the May edition which will share the early results of our dealer and customer satisfaction survey, more about our expanding sales team, and more digital evolutions. Have a story idea or have a suggestion to improve? Please let us know by submitting it via the form below.

Looking Ahead!

We are already planning the May edition which will share the early results of our dealer and customer satisfaction survey, more about our expanding sales team, and more digital evolutions. Have a story idea or have a suggestion to improve? Please let us know by submitting it via the form below.